Cash loans for inDrive drivers

Loan products for personal and business needs

Whether it's a car repair or home renovations, spread the costs with our partners' loans

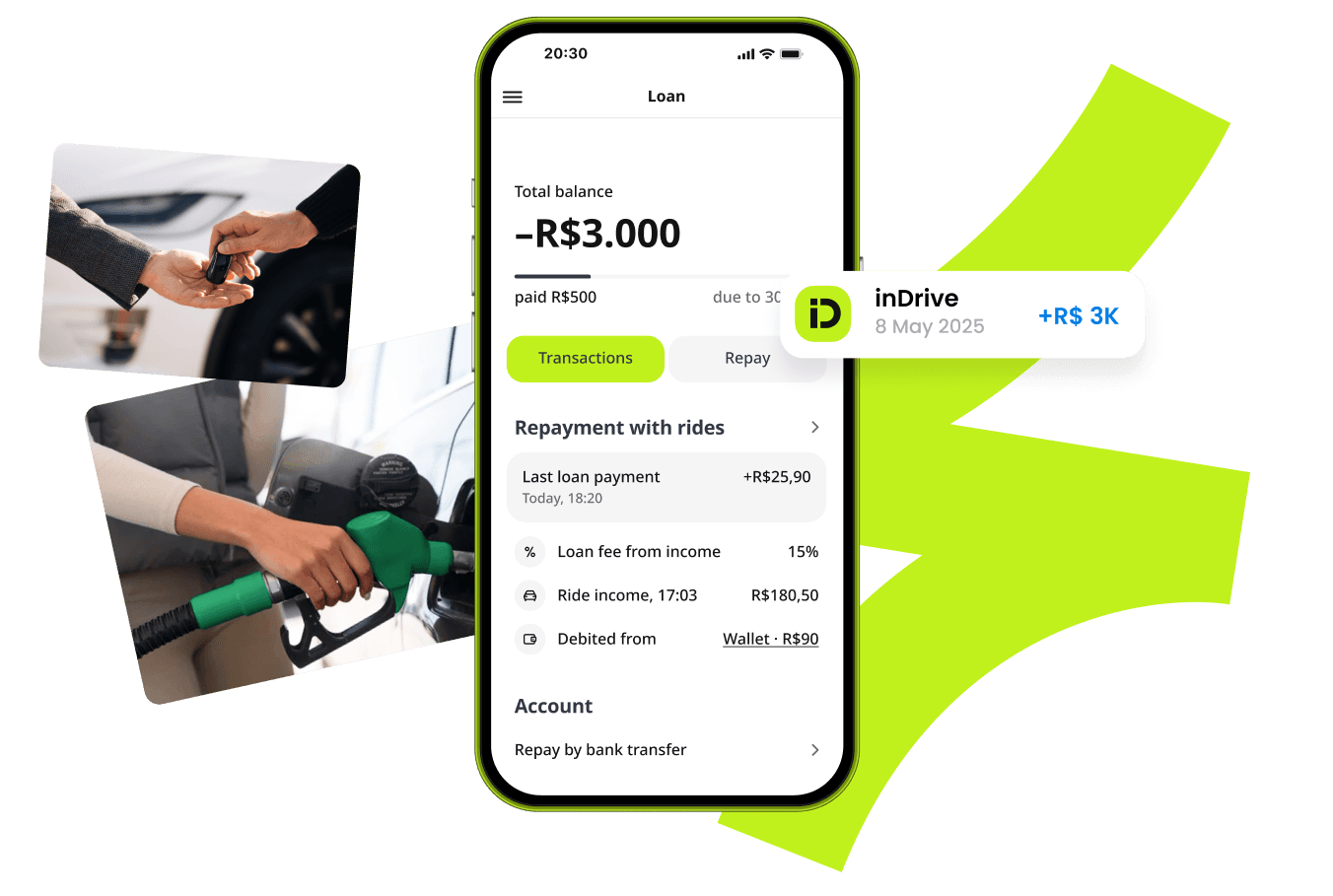

Up to R$3,000

Immediate access to funds based on your activity with inDrive

100% online

Apply and get your loan fully online—no paperwork, no wait. Quick, easy, and hassle-free

Credit limit increase

Drive more to increase your credit limit from our financial partners and unlock new offers

Easy repayment

Your rides pay off your loan. We simply add an additional fee to your ride earnings as repayment

Get a loan in minutes

Already driving with inDrive? Unlock a loan in a few taps—no paperwork, no stress

Check your offer from our financial partners

Stay active, complete rides, and access loan offers

Apply in seconds

No waiting around. Receive an instant decision on your loan application

Get your money

If approved, the funds go straight to your bank account

Why do drivers prefer loans from our partners on inDrive?

Because it is the best loan option in the market and you pay it off gradually, so you don't feel the burden

Good support at work, and personally, I was surprised when I received financial support

Very fast and can be easily received with no paperwork

Join inDrive and earn on your terms

- 4.45K, R$City to City

- 3.1K, R$Courier deliveries

- 6.6K, R$City rides

- 4.09K, R$Freight deliveries

The above amount is based on statistical data from inDrive for the period from 01.01.2024 until 31.12.2024. The calculation is approximate and based on the average income of drivers. Please note that the amount in your account may differ from the stated amount. inDrive does not guarantee that you will receive this amount. Using inDrive does not establish any employment or agency relationship with us.

Frequently asked questions

Does inDrive provide the loan directly?

No, inDrive partners with EmpreX, who acts as a banking correspondent to facilitate loans from a licensed financial institution, BMP Sociedade de Crédito Direto S.A.

Where can I check my application status?

After tapping ‘Get offer’, you'll see the tailored offer. Just give your consent and complete the registration

Where to check the loan terms?

Click 'Get offer' to view key terms, including interest rates and the amount, clearly displayed. Full terms of the loan are contained in the loan agreement, which is available to you in the loan contract section on the account page

What is the CET for the cash loan?

The annual CET ranges from 80% to 170%, depending on the loan amount and the risk analysis. The final CET will be provided in the loan contract.

Is there a monthly minimum payment?

There is no minimum monthly payment amount. However, it is recommended that payment is made within the loan term so that the driver remains eligible for future loan offers.

How to repay the loan?

There are two ways to repay the loan. Percentage of payout per ride: inDrive withholds a fixed percentage of earnings from each completed ride. The amount depends on the offer you chose. There are no daily payments. Direct payments: You can pay directly via PIX or boleto.

For the cash loans offering, inDrive acts as a banking subcorrespondent of BMP SCD, in accordance with the CMN Resolution 4,935. For more information, see Loans Terms of Use